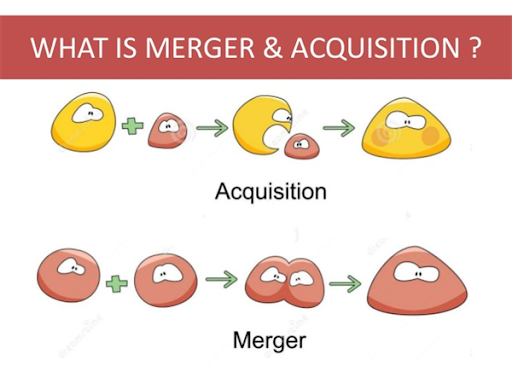

1. What's M&A?

M&A (Mergers and Acquisitions – Mergers and Acquisitions) is the merger and acquisition of enterprises in the market. In principle, in order to conduct an acquisition or merger of a company, it is customary to create new values for shareholders whose maintenance of the old state is not achieved.

2. Major forms of M&A

M&A can be done in various forms. Based on the corporate financial structure, M&A can be accomplished by:

Merger and consolidation: merger is the merger of one company into another, when the merged company ceases to exist, the merged company remains; consolidation will create a whole new company on the basis of the consolidation of the old companies, when the old companies no longer exist;

Acquisition of shares: mainly expressed by the company's collection and purchase of most or all shares of other shareholders; ;

Acquisition of assets: the act of companies negotiating the sale and purchase of certain assets in the target enterprise.

In which, the most common form of M&A activity is the repurchase of shares or the acquisition of assets.

In fact, there is no standard process for an M&A deal, and in this article, TriLaw shares the most general process as follows:

1. Preparation Phase - Prior to M&A

The preparation period for an M&A transaction plays a decisive role in the M&A transaction. For sellers, careful planning and preparation are factors that determine the success of the transaction. For the buyer, this is an extremely important period. The understanding and evaluation of the target audience is critical to whether the parties have reached the formal transaction stage.

In the preparation period for investment, the activities of finding, approaching and evaluating target objects can be divided into 2 steps as follows:

Targeted maximum access can be via several channels such as: Seller marketing, self-searching in the buyer's information network, or through consulting units, brokerage agencies in the same area of business investment or M&A consulting units.

In this step, the scope of the approach depends on the seller's preliminary assessment of the following factors before deciding to proceed to the next step of the acquisition path:

Targeted entities shall have activities in a field consistent with the development direction of the purchaser; ;

Targeted entities often have established or have a certain market share that the seller can continue to exploit in line with the buyer's market acquisition strategy;

Targeted entities often have a long-term or medium-term investment size that can be used as a result of technology investment, taking advantage of management experience, utilizing skilled labor;

Target audience has a certain position in the market, enabling buyers to minimize short-term costs and increase market share, take advantage of cross-sell capabilities or leverage market knowledge and experience to further consolidate and create new business investment opportunities;

The target audience has the advantage of available land, infrastructure, and facilities and is able to take advantage of them to minimize initial investment costs.

Based on the preliminary assessments in step 1, the purchaser will hire legal consulting and professional financial consulting units to evaluate the overall target audience, before making a decision on whether to transact or not.

However, in practice, it is not necessary for the seller to provide all of the information within the enterprise according to the seller's internal information control regulations, specialized law provisions, or at the request of shareholders... Consequently, it is customary for the parties to conclude an information security agreement before the purchaser has access to the seller's information data.

In Viet Nam, during this period, depending on the target audience and the buyer's needs, the buyer will often organize an assessment of either or both:

Financial appraisal report ("Financial Due Diligence") in which compliance with accounting standards, capital transfers, contingency plans, loans from organizations and individuals, stability of cash flows (considering the business cycle), asset depreciation checks, and recoverability of public debt, etc.

Legal Review Report ("Legal Due Diligence": focuses on the full and detailed assessment of legal issues relating to legal status, capital contribution status and eligibility of shareholders, legal rights and obligations of target persons, assets, labor, projects, etc.

Although it is only a step in the overall process of an M&A, the results of the detailed appraisal reports play an indispensable role for the acquirer, helping the acquirer to understand the overall problems faced throughout the acquisition and reorganization process.

2. Phase of negotiation and implementation of transactions - M&A contract signing:

Based on the detailed assessment results, the purchaser determines whether the target transaction type is to acquire all or part of it, as the basis for negotiating M&A content. Some of the issues to note at this stage are as follows:

Understanding the difference between "Merger" (Buy) and "Acquisition" (Coalescing): Buyers and sellers need to understand the types and variations of M&A transactions in order to negotiate the contents appropriately and effectively. In fact, M&A is always put in parallel but has a different nature: With "Merger" (Buy), the acquired company no longer exists, is completely taken over by the seller; meanwhile, with "Acquisition" (Consolidation), the two parties agree to merge into a new company instead of operating and owning it separately. The "Acquisition" itself has many rich variations such as: horizontal merger, market expansion merger, product expansion merger, group type merger, purchase merger, merger, and so on.

Reasonable valuation: Buyers and sellers are often unable to meet at the price of the transaction: the M&A paradox is often mentioned that the buyer offers too high prices and the seller only accepts low prices. To address this issue, parties to M&A transactions often hire an independent valuation unit to determine the value of the purchaser.

The contract should be complete, transparent, and fully anticipated: The product of this phase is a contract recognizing the form, price and content of the M&A transaction. If you go to this stage, you can get closer to the final stage of M&A. An M&A contract is a representation and recognition of the parties' commitments to transactions, both on the legal side and recognizing other M&A-related coordination mechanisms such as finance, labor, management, market development, etc. The contract also needs to estimate the various cases that occurred during and after M&A and the handling of the consequences. In other words, M&A contracts should be designed to be instrumental in ensuring the interests of trading parties throughout the post-M&A period.

The sale and merger of enterprises is only recognized by law when legal procedures have been completed regarding the recognition of a transfer from the seller to the buyer, especially for assets that must be registered with the competent authority are completed.

Upon completion of this step, an M&A transaction can be considered completed.

3. Corporate Restructuring Phase - After M&A:

The post-M&A corporate restructuring phase is a challenge for the acquirer to prevent M&A from collapsing. Buyer's challenges during this period are often personnel uncertainties, changes in management policies, conflicts in corporate culture, etc.

In addition, the resolution of legal and financial issues may have been directed from a detailed assessment stage, but whether the issues were fully addressed and exploited by the acquired firm lies in the purchaser's ability and discipline.

Another headache for managers in the post-M&A corporate restructuring phase is the issue of organizing a re-evaluation, exploiting the human resources of the acquired enterprise, as at the assessment and appraisal stages, buyers often focus more on financial issues. legal and asset without anticipation of all matters relating to "psychology" and "people".

Hotline

Hotline